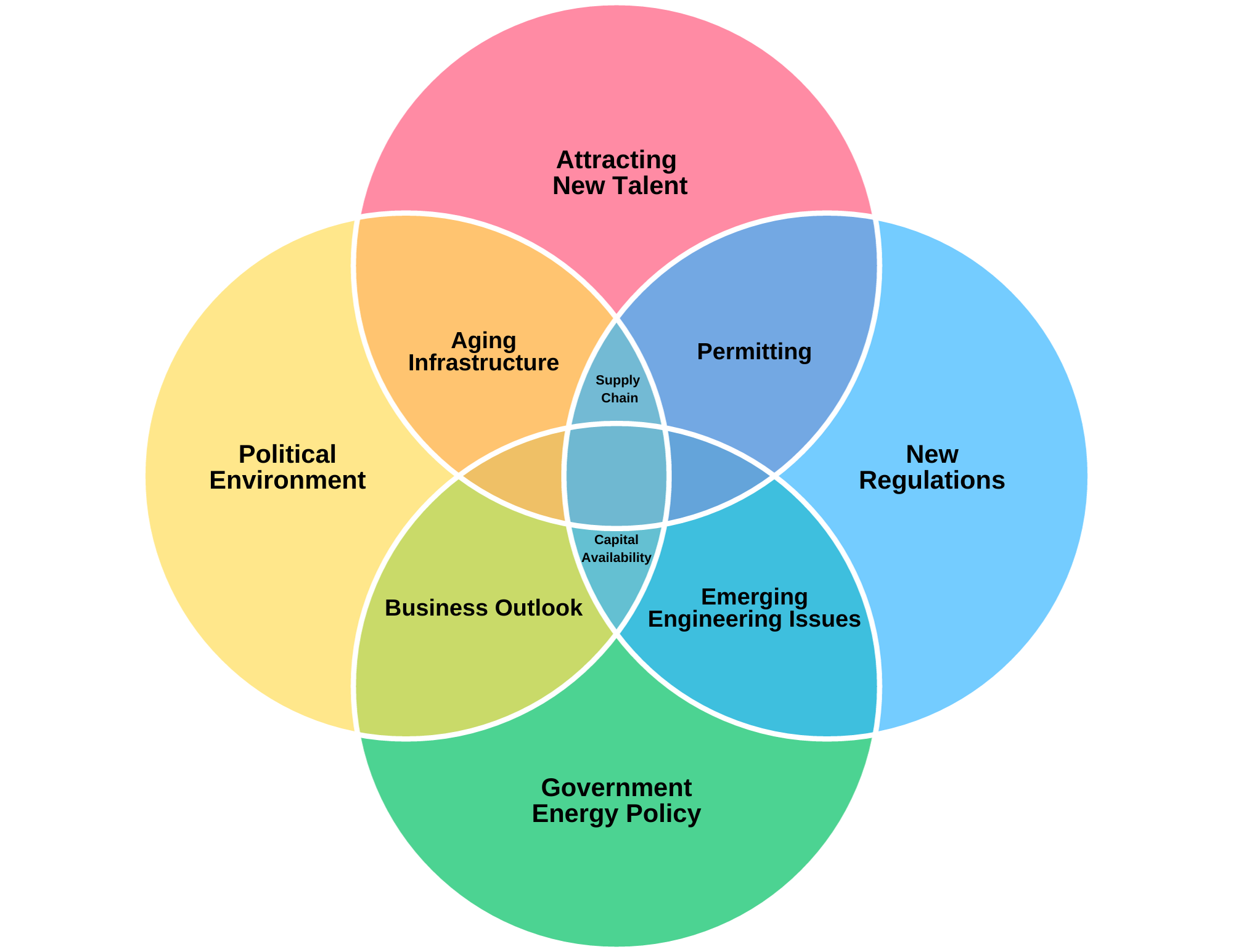

1. Attracting New Talent (same in 2023 survey)

Many young people are not interested in working in a politically vilified industry seen as “dirty,” undesirable, and low tech where long-term employment prospects are uncertain.

2. Political Environment (up from #6)

This apparent cry of frustration can be observed in the October 2023 cancellation of Navigator’s $3.4 billion,1300-mile pipeline project designed to take CO² from ethanol plants across five states to be sequestered in Illinois. It is clear that a dog’s breakfast of untenable, conflicting, and expensive energy policy dictates has created an environment where even those projects officially supported by federal policy and funding cannot get done.

3. New Regulations – tie with #4 (up from #4)

Considerations around public safety continue to be a focus for all regulatory agencies. That said, billions of dollars in investments have been lost or canceled due to political and governmental activism relating to existing and new regulations at the federal and state levels. Additionally, this issue carries with it higher costs and potential liability along with significant confusion and enforcement uncertainty. This issue is clearly a corollary to Political Environment.

4. Government Energy Policy – tie with #3 (new)

A significant part of the electorate and public officials are not supportive of carbon energy, which informs policy that impacts New Regulations, Business Outlook, Permitting, and Capital Availability. This issue is clearly a corollary to Political Environment that is driving capacity and energy constraints while energy demand, notably electricity, increases.

5. Aging Infrastructure (down from #3)

Many of the major pipelines that are relied on to move products across the country are substantially over their original 25-year design life. All operators must improve the way they manage these older energy assets to further extend asset life while enhancing safety and environmental attributes and meeting new regulations. In too many cases, operators' efforts to keep these assets operating safely are being challenged by proponents of green energy who see such work as merely extending the life of carbon-based energy.

6. Business Outlook (new)

Planning is more difficult due to fewer long-term growth opportunities, producer consolidation, re-contracting risk with producers, and building out hydrogen and CO² infrastructure in an unsupportive political, legal, and permitting environment.

7. Emerging Engineering Challenges (new)

Legacy pipeline infrastructure was designed to transport and process methane. Substantial effort is going into figuring out how to economically ship CO² and hydrogen without trying to permit and build new, special-purpose, pipeline systems.

8. Permitting (down from #4)

Federal, state, and local permitting has become a highly uncertain process where, even after permits have been granted, they can be canceled due to new legal challenges.

9. Capital Availability (down from #7)

Political activism related to carbon energy has bled into many federal and state agencies, adversely impacting capital markets, lending institutions, funding costs, and midstream asset valuation.

10. Supply Chain (down from #5)

Delayed delivery and increased costs are making simple maintenance, much less new project development, difficult to evaluate and manage.