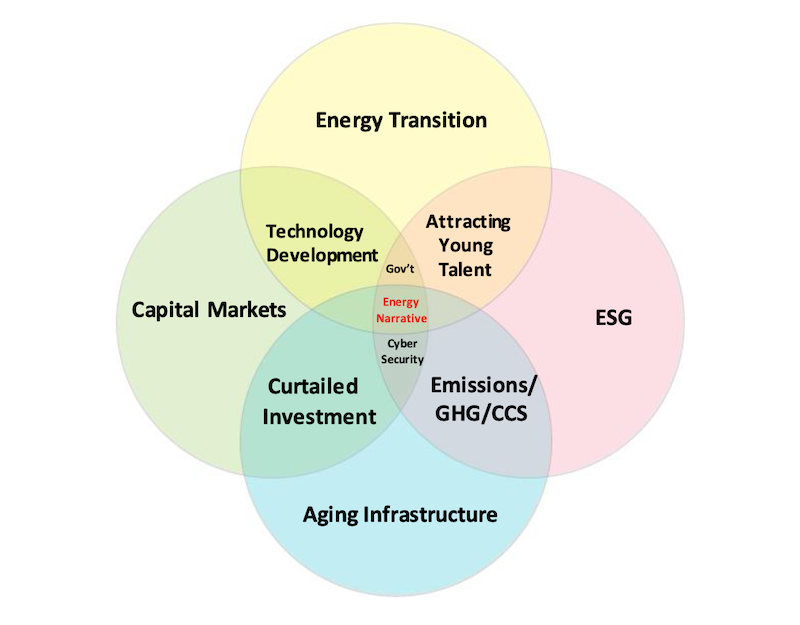

A consistent theme of commentary from survey participants was the integral nature of these issues and the impact of a popular anti-carbon narrative significantly affecting all aspects of society, government, and industry in energy matters. While not making the top ten forced ranking, “Not in My Backyard” or “NIMBY” and Energy Demand concerns gathered enough attention to receive honorable mention. Listed below are the top ten issues facing the midstream industry along with participant commentary:

1. Aging Infrastructure

Many of the major pipelines that are relied on to move product across the country are substantially over their original 25-year design lifespans. All operators are having to improve the way they manage these older energy assets to further extend asset life while enhancing safety and environmental attributes. In some cases, companies are prevented by governmental and political intervention from replacing old assets in lieu of refurbishing them. Such care requires substantial investment and technological advancement, which are negatively impacted by a growing negative carbon energy narrative on permitting and capital markets.

2. Attracting Young Talent

Many young people are not interested in working in a vilified industry seen as “dirty” and undesirable where long-term employment prospects are dampened by the excitement surrounding “green” energy that many claim will supplant carbon energy in the next few decades. A talent shortage is a strategic fear in the midstream industry as baby boomers age and retire.

3. Energy Transition

While energy transition to greener technologies is a worthy goal, dramatic promises and efforts to force unreasonably rapid energy transition promotes a negative narrative ultimately depriving midstream companies of investment capital necessary to safely deliver hydrocarbons. Dampened investment may lead to energy supply disruptions and unacceptable increases in energy costs to consumers.

4. Technology Development

Instrumentation and control systems have improved greatly over the past decade and remote monitoring is gaining broader acceptance. This development means industry has become much better at recording and transmitting data, but the ability to convert that mountain of data into actionable information has lagged. Cloud technologies have become critical along with machine learning and advanced analytics. By gathering better data, being able to trend and develop predictive methods, monitoring and inspection activities can be better targeted to critical elements and processes, making industry more efficient and environmentally sound. However, technology development and implementation require R&D and new investment to make operations safer, more environmentally secure,and efficient.

5. Emissions/GHG/CCS

Regulatory and ESG-focused investor demands for reduction of emissions of Green House Gasses (GHG) along with Carbon Capture and Sequestration (CCS) are materially increasing. Meeting new, enhanced requirements requires technology development and substantial new investment by operators, which in turn requires a stable and supportive regulatory environment.

6. CapitalMarkets

Investorsusuallyseekprofitableenterpriseswithgrowthpotential and manageable risks. Investor apathy has developed towards hydrocarbon-based energy businesses due to an anti-carbon public narrative, demands for quick energy transition, and uncertain regulatory and permitting environments. This investor apathy has reduced capital availability to midstream companies and has reduced company valuations.

7. ESG

Environmental, Social, and Governance (ESG) focus has had the practical effect of dampening investment in the midstream industry. Some banks and institutional investors will no longer lend to energy companies nor have any relationship with them – similarly to what happened with the firearms industry. Environmental concerns are definable and achievable by industry and should continue to be a primary focus of industry. Social concerns may include many considerations for society, but under the “Social” banner, the midstream industry can and must promote an effort to educate the general public about energy transition practicalities of a modern, hydrocarbon-based industrial society. While it is a difficult message to deliver in the current political climate, ignoring this responsibility will ultimately contribute to a critical reduction of affordable energy available to society.

8. Curtailed Investment

Investment is needed not only to keep meeting the energy needs of society as the population and economy grow, but also to continually enhance the entire energy infrastructure to do so in a manner that meets societal requirementsrelatingtoenvironmentalmatters. Midstreamoperatingbudgets remain lower than 2019 and are expected to remain flat, which means that new technology investment and system enhancements necessary to achieve societal aims will necessarily be selective and limited. Ultimately, curtailed investment will lead to higher energy prices and supply disruptions, and perhaps increased environmental risk. Government policy and the negative narrative about the carbon energy industry does not promote stability required for long-term investment.

9. CyberSecurity

Themidstreamindustry’spipelineinfrastructureintheUSis comprised of thousands of companies and millions of miles of pipelines and is a crucial enabler of societal standard of living. Operational Technology (OT) controls equipment while Information Technology (IT) controls data for decision making. Companies rely on the integration of Information and Communication Technologies (ICS) into IT and OT to drive data analytics, automation, and remote operation. The 2021 Colonial Pipeline ransomware attack demonstrated that cyber criminals do not have to attack the most heavily guarded and secure systems, but only cause loss of confidence in these systems – e.g., the Colonial Pipeline billing system shut down led to loss of confidence in everything, including safety systems. Cyber criminals only need to find the weakest link. Corporate systems need to be hardened and, in particular, a societal paradigm shift is required to inculcate into all employees a strong element of personal responsibility. Individuals must come to recognize that they are the guardians of their employers, their jobs, and critical national infrastructure. A paradigm shift such as those regarding cigarette smoking around children and wearing seat belts must be promoted.

10. Government Interference/Regulation

Considerations around public safety continue to be a focus for all regulatory agencies. That said, billions of dollars in investments have been lost due to flip flopping political and governmental activism relating to existing and new pipeline permitting at the federal and state levels. This lack of consistency makes it difficult to make long-term investments in midstream infrastructure, which may ultimately lead to reduced investment causing supply disruptions and increased environmental risks.