Top 10 Issues Facing the Midstream Industry in 2023

The Center for Midstream Management and Science (CMMS or Center) conducted the second annual CMMS survey of its Industry Advisory Board and friends of the Center. This survey drew on opinions from senior industry people in midstream management, engineering, operations, consulting, and academia.

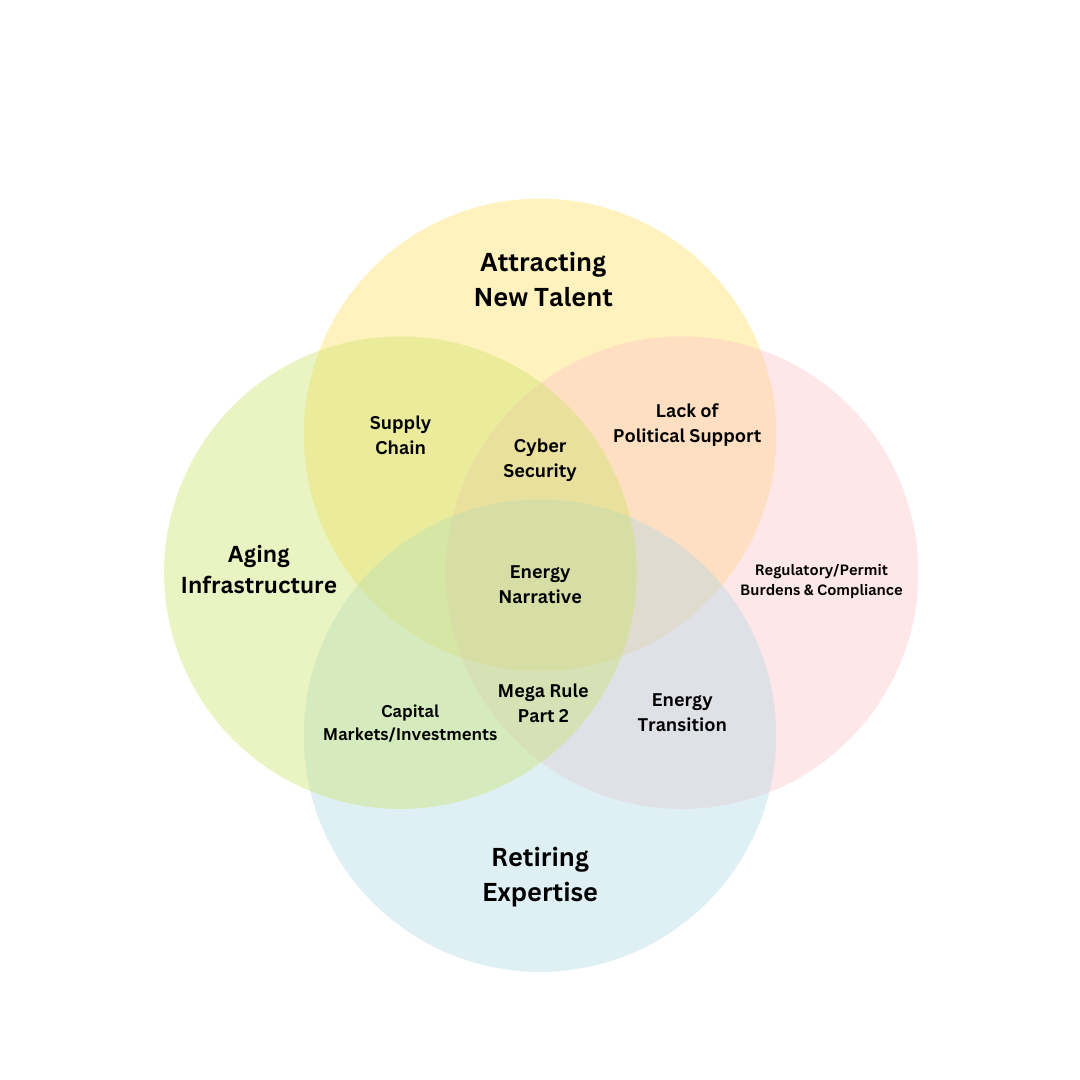

The top ten issues facing the midstream industry in 2023, forced ranked, are:

- Attracting New Talent

- Retiring Expertise

- Aging Infrastructure

- Regulatory/Permitting Burdens and Compliance

- Supply Chain

- Lack of Political Support for Project Investment

- Capital Markets/Investment

- Energy Transition

- Cyber Security

- Mega Rule Part 2